Content

Owner-to-owner sales, however, are subject to a lower rate, which depends on the price of the vehicle and, in some situations, the model year. Income from Illinois sources if your adjusted gross income is higher than your Illinois exemption allowance. You’re an Illinois resident without a federal filing requirement, but your Illinois income exceeds your exemption allowance. The Illinois K-12 education expense credit can knock up to $750 off of your tax bill if you spent more than $250 on qualified education expenses.

Because it’s a cloud-based tool, rate updates are pushed to you automatically, based on the latest jurisdiction rules and regulations. If you make sales in multiple states, illinois income tax rate rate tables can be used to input data into your tax system or maintain as a reference. Get a free download of average rates by ZIP code for each state you select.

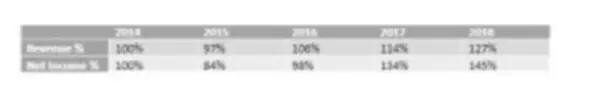

TAX COMPARISONS

The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Additional time commitments outside of class, including homework, will vary by student. Additional training or testing may be required in CA, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials. Available only at participating H&R Block offices.

- Trusts and estates pay 4.95% income tax in Illinois.

- Married couples filing jointly with an adjusted gross income over $500,000, and all other filing statuses with AGI over $250,000, can’t claim the education expense credit.

- Opponents argued it would open the door to future tax hikes, hurt businesses, drive businesses and wealthy residents to neighboring states, and place more revenues in the hands of an untrustworthy state government.

- When cities and towns face dangerously high pension costs, they are forced to raise property taxes to cover shortfalls.

Instruction how to only prepare a IL state return on eFile.com and then download, print sign and mail it in. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers.

Policy Shop

The state derives its constitutional authority to tax from Article IX of the state constitution. Concurrently with the constitutional amendment proposals, legislators debated Senate Bill 687, which lays out the proposed new tax structure which will only go into place if voters approve Constitutional Amendment 1. If the constitutional amendment is approved, Senate Bill 687 would raise taxes on Illinois taxpayers making over $250,000. It also includes $100 million for property tax relief. This bill passed in the Senate by a 36–22 vote on May 1 and in the House by a 67–48 vote on May 30. During the 2018 Illinois gubernatorial election, Democratic candidate J.